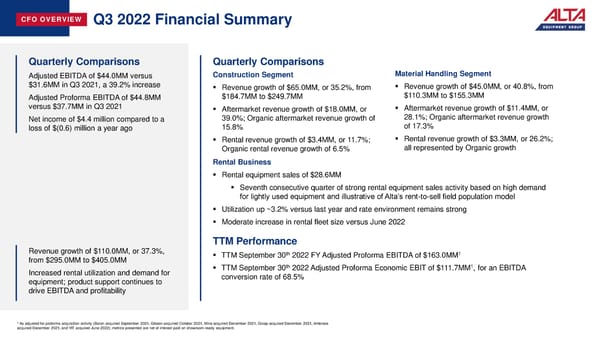

CFO OVERVIEW Q3 2022 Financial Summary Quarterly Comparisons Quarterly Comparisons Adjusted EBITDA of $44.0MM versus Construction Segment Material Handling Segment $31.6MM in Q3 2021, a 39.2% increase ▪ Revenue growth of $65.0MM, or 35.2%, from ▪ Revenue growth of $45.0MM, or 40.8%, from Adjusted Proforma EBITDA of $44.8MM $184.7MM to $249.7MM $110.3MM to $155.3MM versus $37.7MM in Q3 2021 ▪ Aftermarket revenue growth of $18.0MM, or ▪ Aftermarket revenue growth of $11.4MM, or Net income of $4.4 million compared to a 39.0%; Organic aftermarket revenue growth of 28.1%; Organic aftermarket revenue growth loss of $(0.6) million a year ago 15.8% of 17.3% ▪ Rental revenue growth of $3.4MM, or 11.7%; ▪ Rental revenue growth of $3.3MM, or 26.2%; Organic rental revenue growth of 6.5% all represented by Organic growth Rental Business ▪ Rental equipment sales of $28.6MM ▪ Seventh consecutive quarter of strong rental equipment sales activity based on high demand for lightly used equipment and illustrative of Alta’s rent-to-sell field population model ▪ Utilization up ~3.2% versus last year and rate environment remains strong ▪ Moderate increase in rental fleet size versus June 2022 TTM Performance Revenue growth of $110.0MM, or 37.3%, th 1 from $295.0MM to $405.0MM ▪ TTM September 30 2022 FY Adjusted Proforma EBITDA of $163.0MM th 1 Increased rental utilization and demand for ▪ TTM September 30 2022 Adjusted Proforma Economic EBIT of $111.7MM , for an EBITDA equipment; product support continues to conversion rate of 68.5% drive EBITDA and profitability 1 As adjusted for proforma acquisition activity (Baron acquired September 2021, Gibson acquired October 2021, Mine acquired December 2021, Ginop acquired December 2021, Ambrose acquired December 2021, and YIT acquired June 2022); metrics presented are net of interest paid on showroom-ready equipment.

Earning Presentation Page 9 Page 11

Earning Presentation Page 9 Page 11This is a modal window.