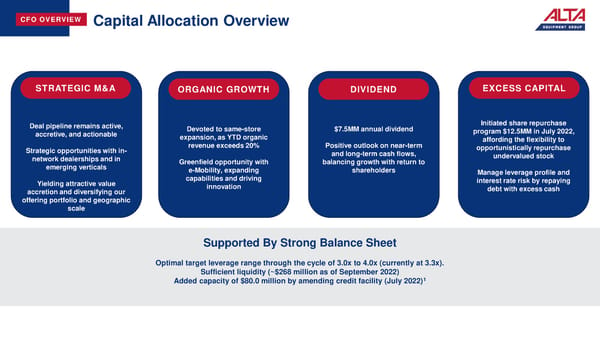

CFO OVERVIEW Capital Allocation Overview Excess Capital STRATEGIC M&A ORGANIC GROWTH DIVIDEND EXCESS CAPITAL Deal pipeline remains active, Devoted to same-store $7.5MM annual dividend Initiated share repurchase accretive, and actionable expansion, as YTD organic program $12.5MM in July 2022, revenue exceeds 20% Positive outlook on near-term affording the flexibility to Strategic opportunities with in- and long-term cash flows, opportunistically repurchase network dealerships and in Greenfield opportunity with balancing growth with return to undervalued stock emerging verticals e-Mobility, expanding shareholders Manage leverage profile and Yielding attractive value capabilities and driving interest rate risk by repaying accretion and diversifying our innovation debt with excess cash offering portfolio and geographic scale Supported By Strong Balance Sheet Optimal target leverage range through the cycle of 3.0x to 4.0x (currently at 3.3x). Sufficient liquidity (~$268 million as of September 2022) Added capacity of $80.0 million by amending credit facility (July 2022)1

Earning Presentation Page 15 Page 17

Earning Presentation Page 15 Page 17