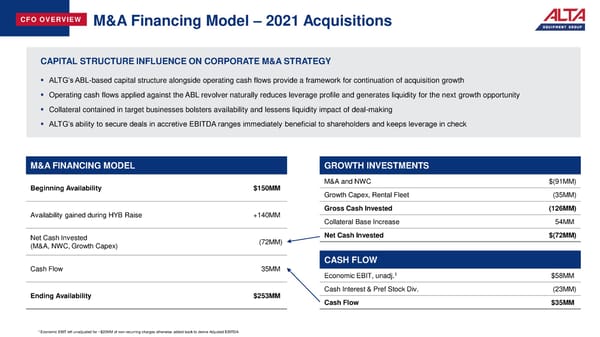

CFO OVERVIEW M&A Financing Model – 2021 Acquisitions CAPITAL STRUCTURE INFLUENCE ON CORPORATE M&A STRATEGY ▪ ALTG’s ABL-based capital structure alongside operating cash flows provide a framework for continuation of acquisition growth ▪ Operating cash flows applied against the ABL revolver naturally reduces leverage profile and generates liquidity for the next growth opportunity ▪ Collateral contained in target businesses bolsters availability and lessens liquidity impact of deal-making ▪ ALTG’s ability to secure deals in accretive EBITDA ranges immediately beneficial to shareholders and keeps leverage in check M&A FINANCING MODEL GROWTH INVESTMENTS Beginning Availability $150MM M&A and NWC $(91MM) Growth Capex, Rental Fleet (35MM) Availability gained during HYB Raise +140MM Gross Cash Invested (126MM) Collateral Base Increase 54MM Net Cash Invested (72MM) Net Cash Invested $(72MM) (M&A, NWC, Growth Capex) CASH FLOW Cash Flow 35MM Economic EBIT, unadj.1 $58MM Ending Availability $253MM Cash Interest & Pref Stock Div. (23MM) Cash Flow $35MM 1 Economic EBIT left unadjusted for ~$20MM of non-recurring charges otherwise added back to derive Adjusted EBITDA

Earning Presentation Page 26 Page 28

Earning Presentation Page 26 Page 28